Trends in the U.S. Printing Industry

Trends in the U.S. Printing Industry

By Jim Hamilton, Consultant Emeritus at Keypoint Intelligence

Article provided by Canon Solutions America

The traditional printing industry is shrinking, which should come as no surprise. What is interesting to note, however, is what’s going on inside those numbers. Recently released information from the U.S. Census Bureau’s County Business Patterns data provides an inside look at the categories in which the industry is shrinking, as well as the areas that have shown some growth in the number of establishments over the past decade.

What Is an Establishment?

You can think of a printing industry establishment as a single work site. The U.S. Census Bureau describes it as the number of locations with paid employees at any time during the year. That means that if a given establishment existed in January 2020 but went out of business by the end of the year due to the pandemic or other reasons, it would still count as an establishment for 2020. This is good to keep in mind when considering the numbers because any businesses that closed during the first year of the pandemic would still be counted in the 2020 numbers.

Another point to consider is how businesses are classified in the government’s categories. As the printing industry has contracted, the Census Bureau has adapted its categories over time. Typesetters and color separators operated as separate categories decades ago, but technology shifted those roles elsewhere. Today, the categories related to printing are focused on four areas in the North American Industry Classification System (NAICS). The top category, Printing and Related Support Activities, goes by the three-digit NAICS code 323. Beneath category 323 are Printing (32311) and Support Activities for Printing (32312). The NAICS printing category breaks out into Commercial Printing (323111), Screen Printing (323113), and Book Printing (323117). Keep in mind also that these categories are self-selecting, so there may be some overlap or misclassification. For example, a prepress house that moved into digital printing might continue to identify itself by its legacy category (prepress) when it might actually be better described as a commercial printer. In addition, a commercial printer that also does a large amount of book work will likely identify itself as a commercial printer.

The U.S. Printing Industry: Number of Establishments

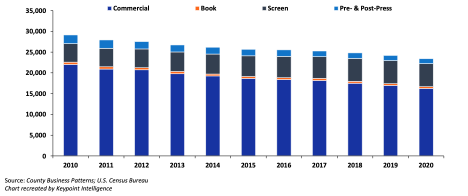

Back in August, some of you might have seen a WhatTheyThink article summarizing the latest printing industry establishment data from U.S. Census Bureau’s County Business Patterns. (By the way, if you don’t already subscribe to WhatTheyThink, you should!) This article noted a steep decline in establishments within the U.S. Commercial Printing market between 2010 and 2020. WhatTheyThink’s August overview did not include Screen Printers, Book Printers, and Support Activities; these were covered in later posts. The Figure below combines the data to provide an overall view of the number of establishments in the U.S. Printing Industry.

Figure 1: Establishments in the U.S. Printing Industry

The raw numbers are startling, though not particularly surprising. While there were a total of 29,118 establishments in the U.S. Printing Industry in 2010, that number had dropped to 23,393 by 2020. This is a loss of 5,725 establishments, or nearly 20% of the figure from 2010. There were certainly some new establishments that also entered the market during that time, so the total loss of existing establishments was even higher than that.

A breakdown of those numbers tells a different story by segment:

- Commercial Printers: The number of U.S. Commercial Printing establishments declined from 22,048 in 2010 to 16,283 in 2020, representing a drop of 26%. This is the largest of the four segments and had the biggest loss in establishments at 5,765.

- Book Printers: The number of U.S. Book Printing establishments shrunk from 536 to 379. Close to 30% of these establishments went away between 2010 and 2020.

- Screen Printers: The number of U.S. Screen Printing establishments actually increased by close to 25%, from 4,454 to 5,563. This unusual development does not point to a tremendous rebirth in screen printing—it speaks to the digital print technologies that screen printers applied to their application sets, such as wide format graphics, promotional items, and printing on non-paper substrates. This level of growth is remarkable since screen printers faced many of the same competitive threats from electronic distribution as commercial printers.

- Support Activities (Pre- & Post-Press): The number of U.S. pre-and post-press establishments, already a fairly small category, dropped by nearly 44% between 2010 and 2020, declining from 2,080 to 1,168.

Table 1: Number of U.S. Printing Industry Establishments – 2010 vs. 2020

| 2010 | 2020 | Change | Rate | |

| Commercial Printing | 22,048 | 16,283 | -5,765 | -26.1% |

| Book Printing | 536 | 379 | -157 | -29.3% |

| Screen Printing | 4,454 | 5,563 | 1,109 | 24.9% |

| Pre- and Post-Press | 2,080 | 1,168 | -912 | -43.8% |

| Total | 29,118 | 23,393 | -5,725 | -19.7% |

Source: County Business Patterns; U.S. Census Bureau

Establishments and Number of Employees

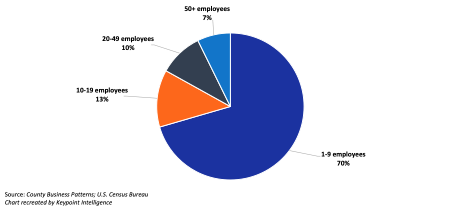

One striking aspect of the County Business Patterns data is in how the U.S. printing industry’s establishments are broken out by employee size. Overall, establishments with less than 10 employees dominate the numbers, representing 70% of establishments. This number varies some by category, with book printers having the fewest smaller establishments (58%) and commercial printers having the most (75%). Smaller establishments can be the most heavily impacted by ups and downs in the economy, and therefore have a big impact on the top-level numbers. Even so, the ratio of small to large printing establishments has stayed fairly consistent over the years.

Figure 2: U.S. Printing Industry Establishments by Number of Employees (2020)

The Bottom Line

What can we make of this data, and what does it tell us? One takeaway is that categories of printers are condensing and combining. This is why today’s printers are so tightly focused on strategies that involve adding new services. This type of expansion and diversification is important for survival, but it also helps explain why competition sometimes comes from unexpected places and new competitors. There is also competition from non-printing sites like marketing firms that nonetheless have added some printing equipment (particularly digital equipment), but are unlikely to define themselves as printers. Indeed, these numbers totally overlook an important printing industry category—in-plants. The government doesn’t track them!

The number of establishments is only one measure of any industry’s size. Revenue is another key one. You can find more data at the U.S. Census Bureau’s County Business Patterns website.

Author bio: Jim Hamilton of Green Harbor Publications is an industry analyst, market researcher, writer, and public speaker. For many years, he was Group Director in charge of Keypoint Intelligence’s (formerly InfoTrends’) Production Digital Printing & Publishing consulting services. He has a BA in German from Amherst College and a Master’s in Printing Technology from the Rochester Institute of Technology.